Imagine knowing how many traders were placing

orders in a stock, before those orders were even fulfilled. Imagine knowing the sizes

of those orders, the speed at which buyers found sellers for them, and the prices of

not only the highest and lowest orders, but all the prices beyond that at any given time.

In other words, imagine having a lens through which you could see a stock s liquidity, the

supply and demand, reliable support and resistances, all in real time, before the rest of the market

even found out. Welcome to the world of level 2 market data.

You will often see many trading streamers, usually day traders, that have the level 2

on their screen when trading. This is because of the major advantage it gives them, and

it can give so much information on the stock they re looking at.

It can tell you if a stock is about to break out, it can tell you if buyers are losing

interest, and it can also tell you if sellers are taking control.

If you don t have the level 2 knowledge in your trading arsenal, you re definitely missing

out on some key information.

In order to understand the level 2, we should

probably go over the level 1 data first. Make s sense right?

The level one data is usually right above the level two. You ve probably heard most

of it before. It s more of the basic type data of the two types, but a lot of traders

still use it. Level 1 data generally provides the following

information. * Bid price: The highest price a buyer is

willing to pay. * Bid size: The amount traders are looking

to buy at the bid price. * Ask price: The lowest price a seller will

sell for. * Ask size: The amount traders are looking

to sell at the ask price. * Last price: The price of the most recent

trade.

* Last size: The amount of shares that most

recent trade was for. The level 1 data provides plenty of basic

intel for a stock. You can just think of the level 2 as an expanded and more in-depth version

of the level 1. In other words, picture the level one as a

rough outline. It gives ya somewhat of what you need, but just the pure basics.

But the level 2 gives traders a clearer picture of what s actually going on with the stock.

Because it provides more data and information on the stocks movement. More information on

trading prices, trader s sizes, and more importantly, more information on who s in control, the

buyers or the sellers. At first, the level two data looks like just

like a bunch of flashing lights and numbers moving up and down randomly.

Almost like an airplane cockpit.

There s so many buttons and dials, you don t even know

what you re looking at. I completely understand that, but once you

kind of know what you re looking for, it becomes a lot easier to read.

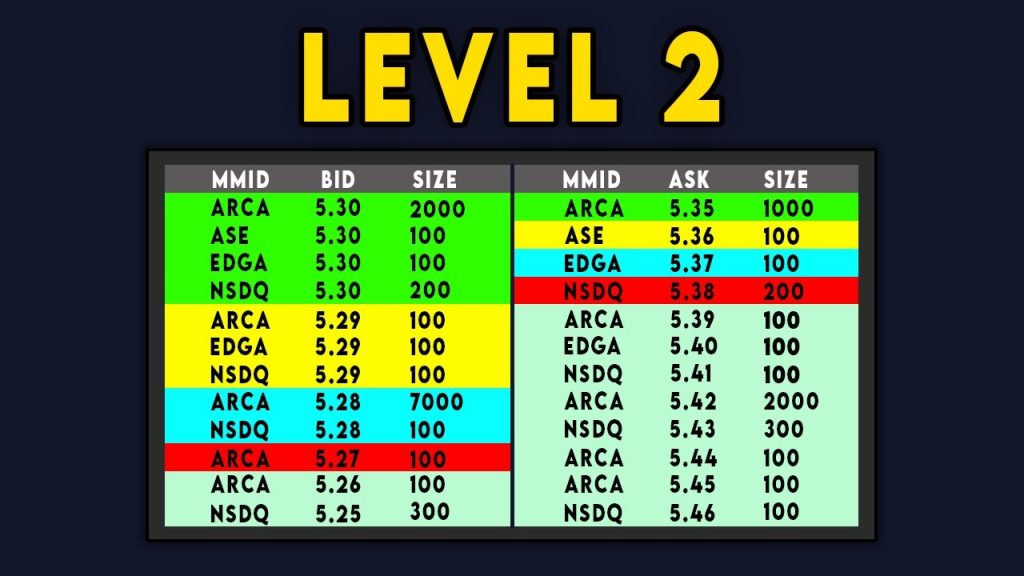

So usually the level 2 looks like this, where everything is moving rapidly, and colors and

numbers are flashing and changing. But I thought I d just take a screenshot so

we can slow down and know exactly what we re looking at without confusing changes and

what not. So as I said before, all this information

right here, is the level one data. Your very basic, foundation data.

Below that is the level 2. We have these two tables. The one on the left

is the bids, or you can think of them as the buyers.

So this right here, is the highest price the market is willing to pay for this stock at

the time.

Which in this example is awx. $So the highest buyers are willing to pay at this

moment is 5.30 The table on the rights is the asks, or you

can think of them as the sellers. So, this right here, is the lowest price the

market is willing to sell AWX for is $5.35. These letters that you are seeing are abbreviations

for exchanges. So it just shows what exchanges these orders are coming from.

Then we have these numbers, which are the size of the orders.

So for example this guy want s to buy 200 shares of AWX if the price ever reaches $5.30

Then there is this person who wants to sell 500 shares if the price ever reaches $5.35

So, I should be clear, all of these orders are limit orders.

So they are all pending,

they haven t been filled yet. They are just requests for where buyers and sellers have

their orders set to. If you did want to see live orders. Orders

that are being filled right at this very moment. You would look at the time and sales. Which

is right here. These are all the orders that have been filed and are currently being filled.

So you can see the price where they were filled, the exchange, and how many shares they bought

or sold. Green means, it was a buy, red means it was

a sell, and grey means it was inside of the spread.

So we went over all the data on the level 2, but how do we use it in order tell if the

buyers or sellers have control? Well from my experience, the level 2 works

the best with key levels of resistance or support.

So say we have this chart, and we found an all time high right here at $5.30 and we were

wondering if the price is going to break through this key resistance or not.

This is where the level 2 comes into play.

If we look at the level 2 data, we can see

a big stack of buyers exactly at the 5.30 mark. You can see there are 5 separate orders

from 5 separate exchanges at 5.30. Whenever this happens the level 2 will make all these

blocks the same color. So in this instance its green.

It does this, so we can quickly see in the blink of an eye, who s in control, the buyers

or sellers. This is actually called stacking . Often people

will say oh the bids are stacked meaning there is a bunch of buyers from different exchanges

try to buy at a specific price. So in this instance, at our key resistance

level of 5.30, there are 5 different buyers willing to buy at this price, compared to

the 1 seller that wants to sell. So we can be more confident the price will

break through this key resistance level. Just picture it as 5 kids vs 1 kid in a fight.

Who s more likely to win? The 5 kids. So whenever trading near a key level of support

or resistance you want to see if there are more buyers or more sellers stacked.

And you

can quickly do that by seeing the big stacks of color.

But this not all you should be looking for, oh nooooo, theres much more information at

hand. You should also be looking at the sizes of

the orders. As an example, yeah, there could be orders to buy at 5.30 from 5 different

exchanges, and only 1 sell order form one exchange.

But if these 5 buy orders are only buying 100 shares each, and the sell order is trying

to sell 10,000 shares. Even though there are more exchanges trying to buy at that specific

price, the size of that one sell order is massive.

So going back to the fight example. Sure there might be 5 kids, but the person by themself

is a ufc fighter. Which could probably take 5 kids at once.

I know it s a weird example, but hopefully I m getting my point across. So you should

not only be looking for big stacks, but also be looking at the sizes of the orders.

So say if there is a huge seller, selling 60,000 shares.

It might not be a good time

to enter. As 60,000 shares is a lot of shares to be bought up and it will almost act a wall

the buyers have to break through. So if you wanted to go long at a specific

level, you want to see big stacks in the bid section, with big order sizes, and you want

see small stacks in the ask section, with small order sizes.

Complete opposite if you wanted to short. Small stacks in the bid section, big stacks

in the ask section. You can also use the level 2 to see where

key levels of support and resistance are.

So if there is a big order size all the way

down here on the bid, that most likely a strong support level. Because a lot of buyers are

willing to buy down here. If there is a big order on the ask, it s likely

to be a key resistance. The higher the number of shares, the more reliable that support

or resistance will be. So the amount of orders and the sizes of them

are a key metric with the level 2, but a just as important metric, is volume. If there is

no volume, the price will not move, which means you wont make money.

So we want to be in when there s a lot of movement. Which nicely enough, the level 2

tells us that information too. We want to be looking at the time and sales,

this right here. We don t necessarily need to be looking at the numbers, but we want

to be looking at the colors and how fast its moving.

So if we wanted to go long, because we think its about to break that key resistance level,

we want to see tons of green, in the times and sales windows.

Telling us there is a lot

of buying going on. Not only that but we want it to be moving

fast. Almost like one of these money counter machines.

If the time and sales is showing a lot of green and it s moving fast. This is telling

us a lot of buyers are coming in at once, in a short period of time. Giving us more

confidence that the price will go up. look at the difference between these two stocks.

Look at the speed of the time and sales. You can see that one stock has way more volume

than the other. So picture it on a chart. There s a ton of

buyers entering trades making the chart go up, but not only that the volume is going

up as well. More and more people are getting excited and entering this trade. But then

the key resistance level comes up, and a lot of people realize that, so they get hesitant

and stop buying.

That s when you ll see the time and sales slow down, and when that happens

at a key resistance level like this, more often than not, it ll reverse.

So as a recap. If we wanted to go long for a breakout trade at that 5.30 mark. We want

to see a lot of stacks at 5.30, and big order sizes. Especially compare to the sellers.

Then we also want to be seeing a bunch of green in the time and sales, and it moving

fast, like a money counter machine. Now, I know I m telling you to look at a lot

of different things at the same time. It can be a little overwhelming at first, especially

with the heat of the moment when trading. And it almost seems like there is too much

going on at once. But just like anything, reading the level 2 is a skill.

The more you do it, the better you become reading it.

When I read a level 2, I can instantly tell who s in control, the buyers or the sellers.

At first it may take you a bit, but you ll get the hang of it.

I promise.

Reading the level 2 is a very important skill to have when day trading, but another skill

that is equally as important if not more important, is being able to read candle sticks, to tell

which direction the market is about to head. In this video I go over some of the most popular

candle stick patterns, and explain how to trade around them. Go check that out. Thanks

for watching, and I ll see you guys, next time..